Explain the relationship between the balance of payment and exchange rates of a country.

There is a close relationship between balance of payment and the exchange rates of a country currency. For the purpose of understanding the relationship between the balance of payment and the exchange rate. There are two types of situations:

- Flexible Exchange Rate System.

- Fixed Exchange Rate System.

Flexible Exchange Rate System and Balance of Payment.

Under the flexible exchange rate system, the equilibrium spot exchange rate, like any other market price, is determined by the equality of market demand for and supply of currencies generated on trade, investments (assets), hedging, arbitrage and speculative accounts. Let us take an example to explain the relationship between the balance of payment and the exchange rates of a currency. Suppose imports of a country are worth 5,000 million dollars while export earnings are 4500 million dollars. Thus, there is a deficit of 500 million dollars. Now the central bank has two options:

- Central bank should supply 500 million dollars from foreign exchange reserves to meet the excess demand.

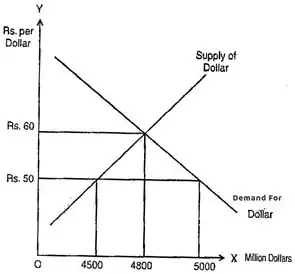

- Central bank should not supply any dollars at all. In such a case the excess demand for dollars will exert pressure on the exchange value of currency say Rupee. If the Rupee rate was. Rs. 50 per dollar before deficit, it may change to Rs. 60 per dollar. Following figure shows this:

In the diagram we see that at Rs 50, the demand for dollar is 5000 million dollars While supply of dollars is 4500 million dollars, leaving an un-adjusted deficit of 500 million dollars. The rate will automatically change to Rs 60 per dollar. With dollar being more expensive, import demand will fall from 5,000 million dollars to 4,800 million dollars.

The exporters will be motivated to export more from 4,500 million dollars to 4,800 million dollars. Thus, exchange. rate is adjusted without the intervention of central bank. If the exchange rates are freely flexible, there will not be a deficit or surplus in the balance of payment because such imbalances are automatically adjusted in the foreign exchange markets.

When the exchange rates change i.e. depreciate or appreciate, there will be change in balance of payments due to change in imports and exports i.e. terms of trade. Depreciation makes the imports more expensive. The prices of exportable are expressed in the currency of home country where the prices of importable are measured in the currencies of the exporting countries. Thus, after rupee depreciates the rupee prices of importable rise relative to the rupee prices of exportable causing a deterioration in the commodity terms of trade.

Fixed Exchange Rate System and Balance of Payment.

Under the fixed exchange rate system a government is committed to maintain the stated or official par value of its currency, allowing the deviation of currency value from the par value only within a fixed or an agreed upon percentage, say one per cent on either side of the par value.

The central bank intervenes in the foreign exchange market to maintain the par value and if it could not be maintained the exchange rate is officially devalued or revalued. Thus, under the fixed exchange rate system a deficit in the balance of payment is adjusted by money supply changes and the consequent changes in the price level. The exchange rate is not used as a tool for correcting the imbalance in the balance of payments.

Under the fixed exchange rate system, a deficit in the balance of payment is adjusted by a fall is national income if the resources are not fully employed.