How would you treat the following items in the cash flow statement: (i) Proposed Dividend, (ii) Provision for taxation, (iii) Profit or Loss on Sale of Fixed Assets?

Proposed dividend: is proposed by the board of directors and approved by the shareholders in the annual general meeting before it becomes due for payment.

- Till the time it is approved at the annual general meeting, it is not a liability.

- The proposed dividend for the current year becomes due and is paid in the next year. It is an outflow of cash and cash equivalents in the next year.

The proposed, dividend of the previous year becomes due and is paid in the current year. It is an outflow of cash and cash equivalent in the current year.

Accounting Treatment of the Proposed Dividend shall be as follows:

- Proposed Dividend (Current Year) : Add back to the current year’s profits to find out cash from operating activities.

- Proposed Dividend (Previous Year) : Cash used in financing activities.

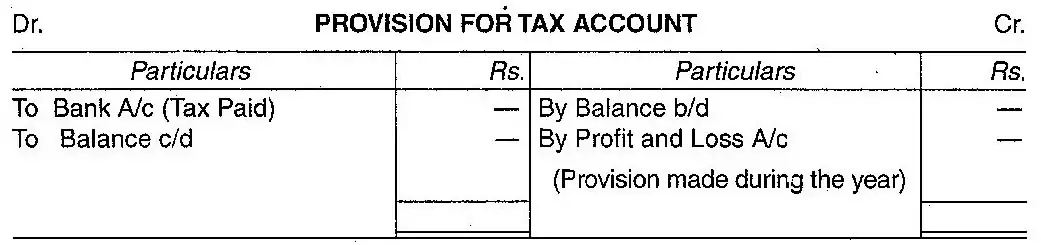

Provision or Tax : If provision for tax is given in the two balance sheets and no information about tax paid is given, the amount in the previous year’s balance sheet is treated as the tax paid during the current year. It involves an outflow of cash.

The current year’s provision for tax represents the amount of tax provided for the current year. It is added back to the current year’s profits to calculate cash from operating activities (under the indirect method). It is merely a book entry and does not involve the outflow of cash. The provision for Tax Account provides information about the tax paid during the current year. as well as the tax provided for the current year.

Profit or Loss on Sale of Fixed Assets : For calculating profit loss, loss on sale of fixed asset is debited profit & loss account whereas profit on sale of fixed asset is credited to profit and loss account. It will not involve any movement of cash. These are simply book entries. Therefore, loss on sale of fixed asset is to be added back and profit on sale of fixed asset is to be deducted for arriving at the cash flows from operating activities.

It is to be noted that sale proceeds of fixed assets is certainly g cash flow but this inflow will be shown in the cash flow statement under cash flows from investing activities.