What is Investment Function According to Economics?

Investment Function:

The classical economists opined that saving as well as investment both are a function of rate of interest. Saving is a direct function of rate of interest while investment is an indirect function of rate of interest. An adjustment in rate of interest brings about equilibrium in money market.

But J. M. Keynes did not agree to it. He opined that investment depends on the expected returns on it. Investment takes place in an economy because it gives certain returns. The return to investment can be known by estimating marginal efficiency of investment. It refers to addition in total output when capital stock increases by one unit.

Rate of interest is the opportunity cost of investment. If invested funds are borrowed one, then it is explicit cost and even if the entrepreneur invests his own funds, it is implicit cost. So, whether to undertake an investment or not, an investor compares rate of interest with return on investment i.e. marginal efficiency of capital.

- If Marginal efficiency of capital > Rate of Interest, it is advisable to undertake investment.

- If Marginal efficiency of capital < Rate of Interest, it is advisable not to undertake investment.

- If Marginal efficiency of capital = Rate of Interest, consider other factors like risk involved, future expectations etc.

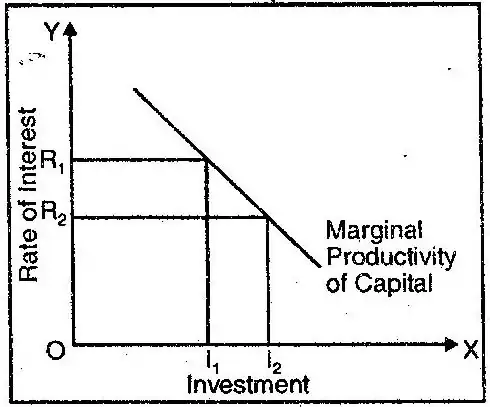

The relationship between investment and MEI is negative i.e. as we increase investment, the additional returns expected on it keeps on decreasing. It is shown with the help of following diagram.

Investment is undertaken not only for the present but for the future and continues for a long time, therefore, uncertainty also lays a vital role in taking investment decisions.

There are many econometric models of investment behaviour and two of these are explained below:

The Accelerator Model: it states that rate of investment depends on the level of AD. In other words, it states that the desirable level of capital stock in an economy is a constant fraction of the level of output.

K = h. Q

Where K is capital stock h is constant and Q is level of output. Therefore, more will be the level of output more will be the rate of investment. During boom, when entrepreneurs are certain about future returns, they tend to invest more. On the other hand, during recession, the rate of investment is less due to uncertainty regarding returns. Another notable point is that investment is not only influenced by level of output, but it also influences the level of output. (Multiplier concept).

The Adjustment Cost Model:

It states that a firm undertakes a study regarding feasibility of the investment, machine analysis and financial arrangements before implementing an investment decision. An investor also considers the cost of training the workers to operate new technology, installation of new machinery and disruption of production chain. According to this model, the actual level of investment is always less than desired level of investment.